Frequently Asked Questions About ComfortProtect

Product & Coverage

What is ComfortProtect?

ComfortProtect is the only Personal Accident Insurance offered by a local point-to-point transport operator that provides coverage beyond the car ride and up to 24 hours, as well as 14 days of COVID-19 coverage. ComfortProtect is priced affordably at just S$0.30 (inclusive of GST) per opt-in coverage.

Comfort Transportation Pte Ltd shall undertake ComfortProtect as the master policyholder for the benefit of you as the insured member.

Which Insurer underwrites ComfortProtect?

ComfortProtect is underwritten by HL Assurance Pte Ltd (HLAS) and is exclusively available to users of the CDG Zig App. HLAS is a member of Hong Leong Group, a leading conglomerate with diversified businesses in banking and financial services, manufacturing and distribution, property development and investments, hospitality and leisure, and principal investment with presence in Asia, Europe, North America and Oceania. It is also a licensed general direct insurer with the Monetary Authority of Singapore and is also a member of the General Insurance Association in Singapore.

What does ComfortProtect cover?

ComfortProtect covers:

- Accidental Death and Permanent Total Disability – Protect yourself against accidental death and permanent disability due to accidents up to $50,000. Please refer to the Policy wording for the full details and coverage.

- COVID-19 Cash Benefit – S$500: HLAS will pay you the Benefit Limit if you

(a) had taken a COVID-19 Polymerase Chain Reaction (PCR) test and are tested positive for COVID-19 within 14 days from the date of your car ride as specified in the latest Policy schedule issued to you; and

(b) are hospitalised to receive in-patient treatment for a consecutive period of at least 3 days.

Who are eligible to opt-in for ComfortProtect?

You are eligible to opt-in for ComfortProtect if you are between the age of 18 and 65 years old. You must be a Singapore Citizen, Permanent Resident or a foreigner holding a valid pass issued by Singapore government and is residing in Singapore. You must also not be employed in any of the professions listed in the “General Exclusions” terms of ComfortProtect.

Opt-in for ComfortProtect on the App

Where can I opt-in for ComfortProtect?

ComfortProtect is available exclusively via the CDG Zig App and you can opt-in for ComfortProtect when choosing the ComfortRIDE or by meter option.

On the App’s booking screen, simply enter your destination(s), then select ComfortRIDE or by meter option. While waiting for your driver or when you are onboard before the trip ends, you can select “Activate Insurance” on our App’s ComfortProtect menu. Fill up a simple registration form, and you will be able to opt-in for ComfortProtect for the ride.

Please note that you must use a cashless payment mode (all except for Cabcharge) in the App, in order to opt-in for ComfortProtect.

Can I use any promo code when I am opting-in for ComfortProtect?

You can apply any available promo code to the total fare amount, which include the premium of ComfortProtect. The promo code must be applicable to the cashless payment mode you have chosen in the App to make the trip booking.

Can I opt-in for ComfortProtect to cover other passengers (e.g. my family members, friends) who are with me on the same ride?

ComfortProtect’s coverage is only extended to the passenger who has booked the ComfortRIDE or meter option and opted-in for ComfortProtect via the CDG Zig App. It does not cover other passengers on the same ride.

Can I opt-out from ComfortProtect for my next ride?

Once you have opted in and activated ComfortProtect, the insurance coverage will be automatically applied on each of your subsequent ComfortRIDE or meter option bookings.

However, you can always opt-out from ComfortProtect for your next ComfortRIDE or meter option booking. Simply go to the ComfortProtect menu in the App, and tap “Deactivate Insurance” before you make your ComfortRIDE or meter option booking.

When will I receive the Policy Schedule for ComfortProtect which I have opted in?

Your ComfortProtect Policy Schedule will be sent to your email address at the time when your booked ComfortRIDE or meter option ride starts.

How am I covered if I have made multiple trips with ComfortProtect opted-in within the same day?

When you make multiple trips with ComfortProtect opted-in within the same day, the subsequent 24-hour coverage period for Personal Accident starts after the first 24-hour coverage period ends, and up to a maximum of 90 consecutive days of coverage.

For the COVID-19 Cash Benefit coverage, there will only be one active coverage at any given time. The coverage period will be effective 14 days from the latest ride’s date.

Please also refer to “Illustrations of Multiple Trips with ComfortProtect Opt-in” in the later section of these FAQs.

Claims

How do I make a claim under ComfortProtect?

First you will need to download the claim form from this link. Email your completed claim form and supporting documents to: [email protected].

Please quote your ComfortProtect Policy Schedule details on all correspondences. Do note that HLAS should be notified within 14 days from the injury.

Contact

What should I do if I have further enquiries on ComfortProtect?

Please contact HL Assurance Customer Care Hotline at 6702 0202 (Mon – Fri, 9.00 am – 6.00 pm) or email your questions to [email protected]

Illustrations of Multiple Rides with ComfortProtect Activated

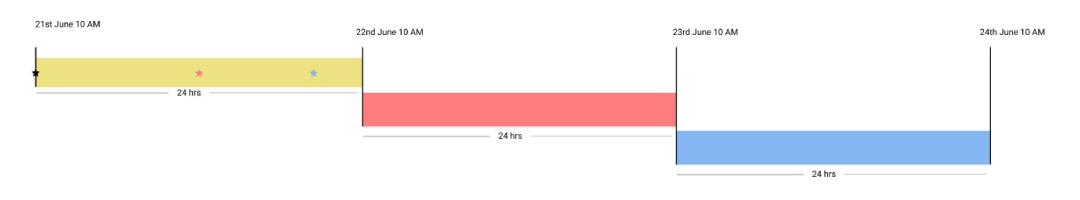

Illustration 1 - Multiple Rides with ComfortProtect Activated (Personal Accident Coverage):

| Taxi Ride Date & Time | ComfortProtect Personal Accident (Death and TPD Coverage) | |

| Coverage Starts | Coverage Ends | |

| 21 June 2021 10AM | 21 June 2021 10AM | 22 June 2021 10AM |

| 21 June 2021 2PM | 22 June 2021 10AM | 23 June 2021 10AM |

| 22 June 2021 7AM | 23 June 2021 10AM | 24 June 2021 10AM |

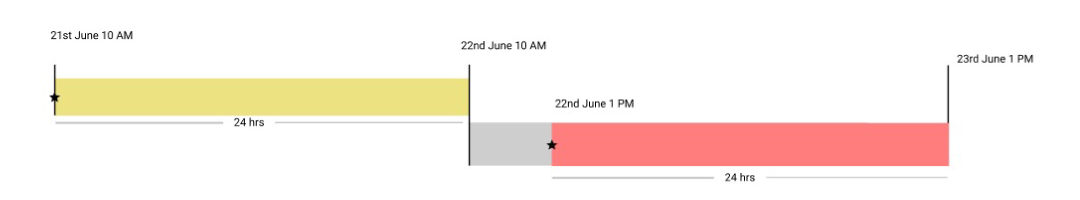

Illustration 2 - Multiple Rides with ComfortProtect Activated (Personal Accident Coverage):

| Taxi Ride Date & Time | ComfortProtect Personal Accident Coverage (Death and TPD) | |

| Coverage Starts | Coverage Ends | |

| 21 June 2021 10AM | 21 June 2021 10AM | 22 June 2021 10AM |

| 22 June 2021 1PM | 22 June 2021 1PM | 23 June 2021 1PM |

Note: Period between 22 June 2021 10AM and 22 June 1PM will not be covered

Illustration 3 - Multiple Rides with ComfortProtect Activated (COVID-19 Coverage):

| Taxi Ride Date & Time | ComfortProtect Covid-19 Coverage | ||

| Coverage Starts | Coverage Ends | Most Recent Taxi Ride | |

| 21 June 2021 10AM | X

(Applicable Coverage Period as per Most Recent Taxi Ride)

|

||

| 21 June 2021 2PM | |||

| 22 June 2021 7AM | 22 June 2021 | 6 July 2021 |

✓

|

If the Insured is tested positive from a Covid-19 Polymerase Chain Reaction (PCR) test on 24th June 2021 and hospitalised for inpatient treatment for at least three consecutive days, the Covid-19 Cash Benefit is payable.